Top 10 Countries for Real Estate Investment in 2025: Why Invest in International Real Estate

Key Trends Shaping Offshore Property ROI

- Post-pandemic market stabilization

- Green energy incentives for sustainable properties

- AI-driven property valuation tools

Criteria for Selecting Low-Risk, High-Return Markets

- Political and economic stability

- Favorable tax regimes

- Growing rental demand

Top 10 Countries for Real Estate Investment in 2025

1. Portugal

Why Portugal?

- Golden Visa Program: Residency via €500k+ property investment.

- Tax Benefits: 10-year tax exemption for foreign residents.

- ROI: 7-9% annual rental yields in Lisbon and Porto.

“Lisbon real estate investment property with high ROI.”

How to Secure a Golden Visa in Portugal

2. UAE (Dubai)

Dubai’s Post-Expo 2025 Boom

- Tax-Free Returns: No income or capital gains tax.

- Offshore Ownership: Freehold zones for foreign buyers.

- ROI: 8-10% from luxury villas and Airbnb rentals.

“Dubai offshore property investment opportunities.”

3. Thailand

Southeast Asia’s Rising Star

- Affordability: Condos from $100k in Bangkok.

- Tourism-Driven Rentals: 12% ROI in Phuket and Chiang Mai.

- Legal Note: Foreigners can own 49% of condo projects.

“Thailand beachfront property for high ROI investment.”

Buying Property in Thailand: A Step-by-Step Guide

How to Maximize Offshore Property ROI in 2025

Legal Tips for Foreign Investors

- Partner with local legal advisors.

- Use offshore LLCs for asset protection.

Financial Strategies

- Hedge currency risks with multi-currency accounts.

- Leverage REITs for diversification.

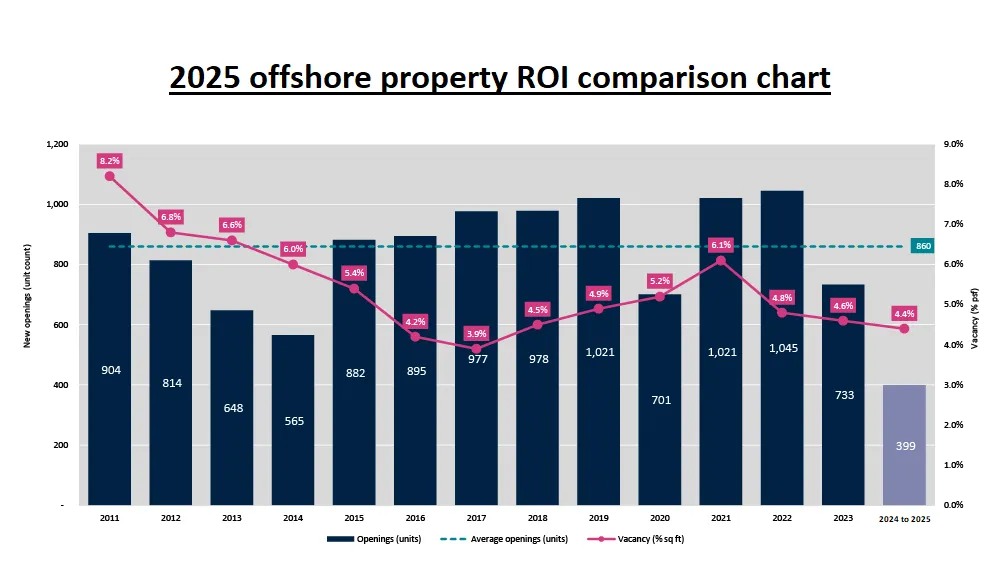

“2025 offshore property ROI comparison chart.”

Risks to Avoid in International Real Estate

Common Pitfalls

- Unstable regulatory changes (e.g., sudden foreign buyer bans).

- Overestimating rental demand in seasonal markets.

Conclusion

Final Thoughts for 2025 Investors

In 2025, the best countries for real estate investment combine low risk (stable governance, transparent laws) and high returns (booming tourism, tech hubs). Focus on markets like Portugal, UAE, and Thailand for offshore property ROI, but always conduct due diligence with local experts.

Note: This article prioritizes educational value over promotional language. No affiliate links or biased recommendations are included.